While we love frequent travel we don’t love paying full price for it. The less you pay the more often you can get away. Here’s some beginners tips to play the travel hacking game.

I live for a deal; ballin’ on a budget if you will. Travel as much as you can, when you can, but, most importantly, as cheaply as you can. After all, spending less on Trip A leaves more money for Trip B and C and, dare I dream, Trip G?? Here are a few tricks to use with the shopping you were already doing to accrue points for travel on the cheap.

Our first dabble into “credit card points to fund your travel” started over 10 years ago with the Southwest Airline card. Being a Southwest credit card holder meant using our daily expenses to cover flights, access family boarding, and get free checked bags for ski trips, but lately Southwest has lost all their good perks. We needed to transition to cards that didn’t put all our points “eggs” in one basket, and we needed more international reach so we dipped our toes into the Flexible Travel Card world.

Flexible Travel Cards are credit cards that accrue points that can be transferred to many different airlines and hotels and from which you can book travel for even cheaper than what you’d find in your credit card’s portal.

We started with two and they happened to be the most popular for their ease of use and ability to transfer to multiple airlines and hotels.

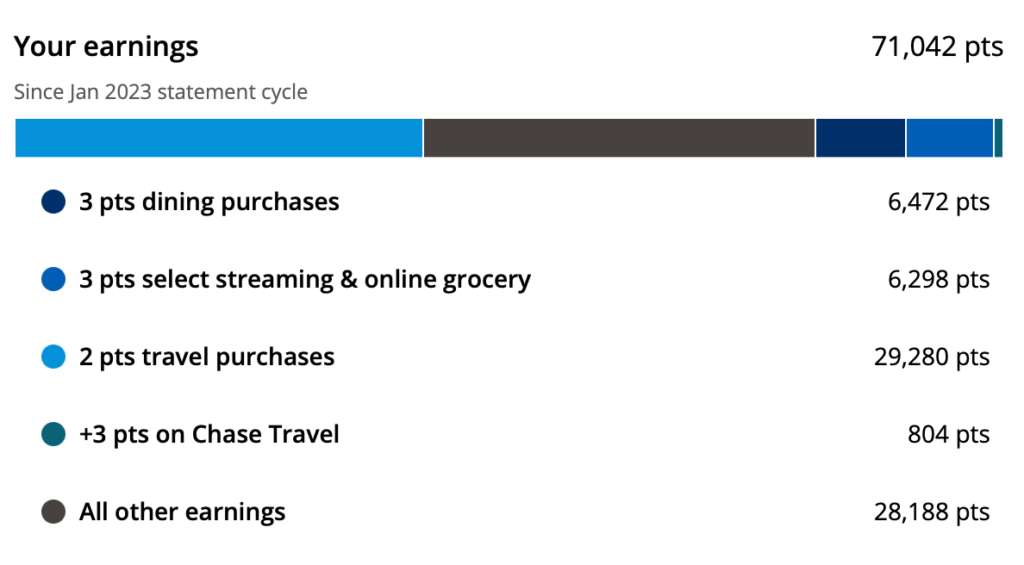

My first, which is still lauded by most in the credit card game as the best for beginners, is the Chase Sapphire Preferred. (Update 4/8/2025-ELEVATED welcome bonus of 100,000 points!) Chase travel cards–both this one and its fancier sister card, the Chase Sapphire Reserve–are fan favorites for their extensive transfer partner portfolio. This means you earn points on this card, and then you can redeem them for flights at one of eleven different frequent flier rewards programs or for hotels through one of three hotel member rewards programs. When we booked Paris for a family of five for spring break, I was able to take my Chase User Rewards (their points currency) and transfer them directly to AirFrance to book my super low point flights.

This card also offers great travel, baggage delay, and auto rental insurance. Most people book their travel with this card because if their luggage is delayed or there’s some kind of trip interruption, Chase will cover it.

These flexible travel cards often come with an annual fee. Boo, right? However the benefits more than pay for it. Chase benefits include free DoorDash Dash Pass membership, and 3x points on dining and online groceries (think Instacart and grocery store park and pickup). For Preferred, there’s also a $50 hotel credit for reservations booked on their site to help cover the $95 annual fee.

The goal in the points game is to be earning more than 1 point for dollar spent, so the 3x points on dining and groceries is nice in addition to all of the included travel protection.

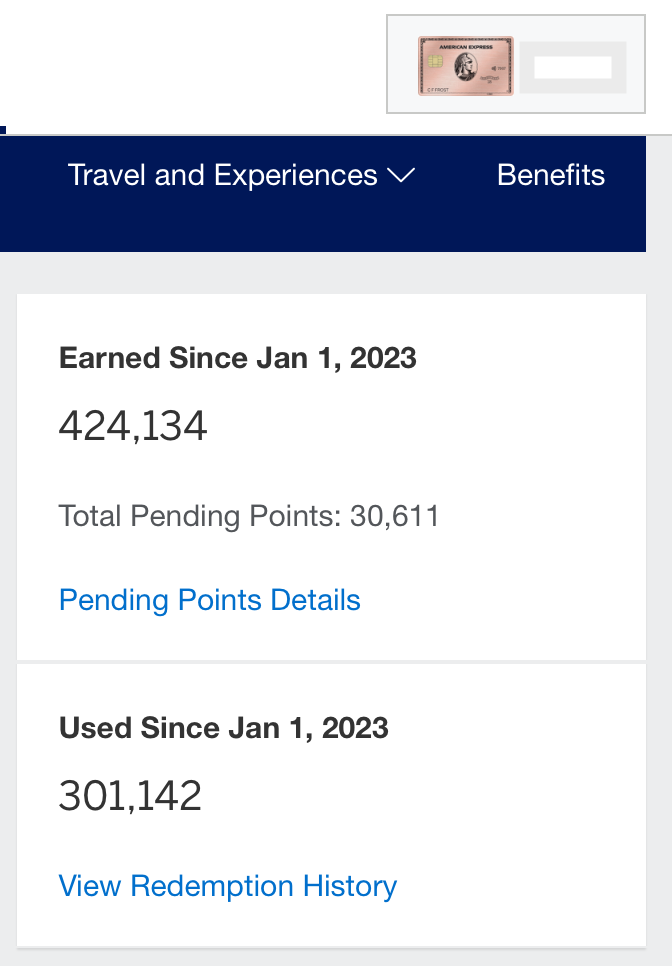

My other card is my points-earning workhorse, the America Express Gold (Amex). (Update 2/17/25: Current sign on bonus elevated to 100,000 if opened in google chrome incognito browser!) This little golden nugget (pun intended) gets me most of my daily points as it offers 4x on all dining and groceries (so literally anything you can buy at, say, Meijer will code as 4x the points). This is most of what we spend money on in our house— food we cook and food other people cook for us.

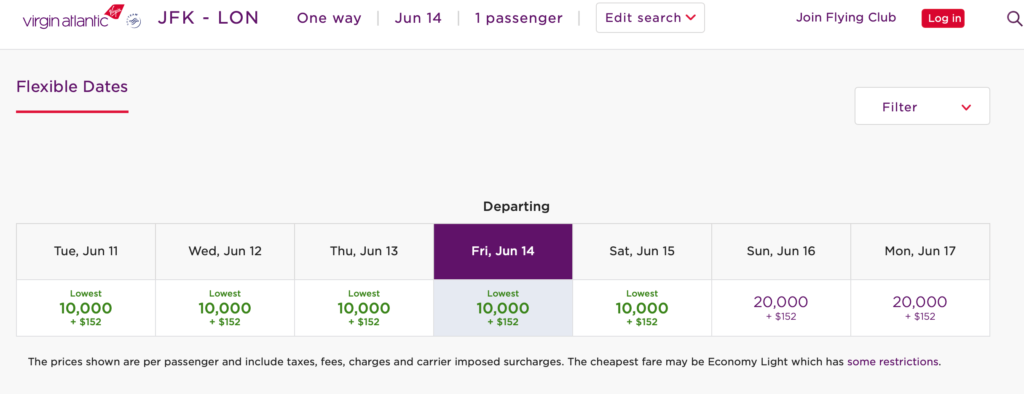

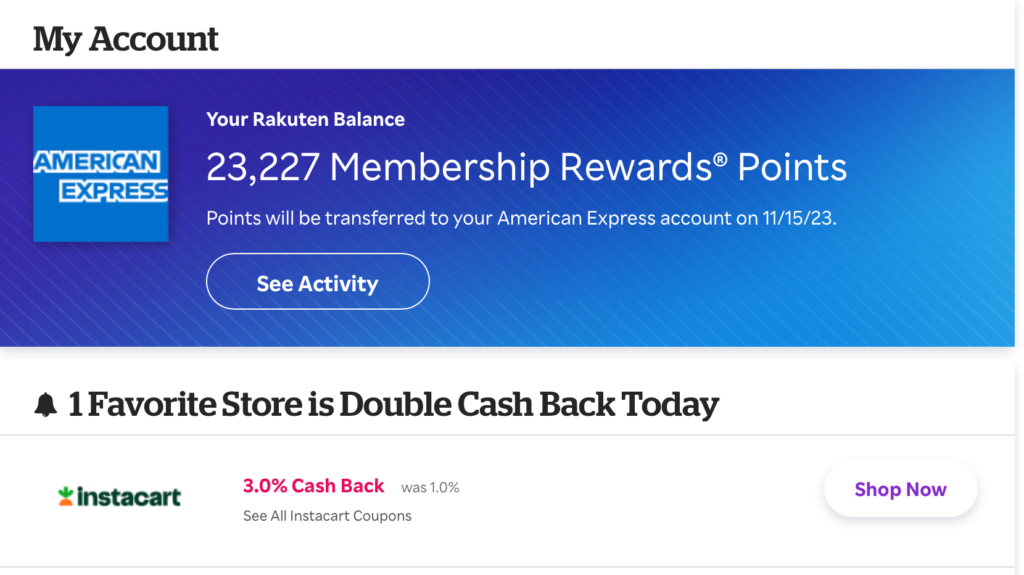

Although it has some coverage, the Amex offers less in travel protection, but it also opens up the world of gaining points through the online shopping portal Rakuten . Rakuten is a free online shopping portal that offers either cash back through their site OR, if linked to your American Express account, points back instead. Whenever I’m online shopping, I start through their website or app to claim credit for my purchases. It earns me on average about 20,000 plus extra points per quarter. That’s two one-way flights from JFK to London this summer! Open an account right now and you and I both get $30 or 3000 points!

How does this work, you ask? Say I need to get some new shoes for the kids. They will just die if they’re not Nike. I can search “Nike” on Rakuten, and they show all the stores they support that sell them and how much cash back is at each store. Nike.com might be 2% back, while Shoes.com is 8%, and Zappos.com might be 10%, so I’ll pick the particular store based on the highest cash back. Rakuten will literally send you a check for all your cash back every quarter. Cash is nice, but points are more valuable. By linking Rakuten to my Amex account, instead of 10% back I get 10x the points to my American Express point bank even if I pay with an entirely different card.

$50 shoes with 10x points is 500 points to Amex plus the 1 point/per dollar I’ll be getting with whatever card I’m using. That’s 550 total points for something I was already buying. Maneuvers like this help get you thousands of points online doing the spending you were already doing! With my Amex Gold, I’m getting plenty of points buying groceries and dining but also getting the quarterly Rakuten return on top!

And this is just the BEGINNING! Check back periodically for more tips on stacking the deals and optimizing these points for redemption for awesome deals!

Check out how to use the Capital One Venture X for free lounge access!

Check out how we did Spring Break in Paris for cheaper than Florida!

One more comment about travel cards… don’t ever just google for an offer. Please use my links, another travel blogger or friend to support their efforts. When you use my links I get points back in return. Everyone wins!